Strategic Presence in Southwest Florida

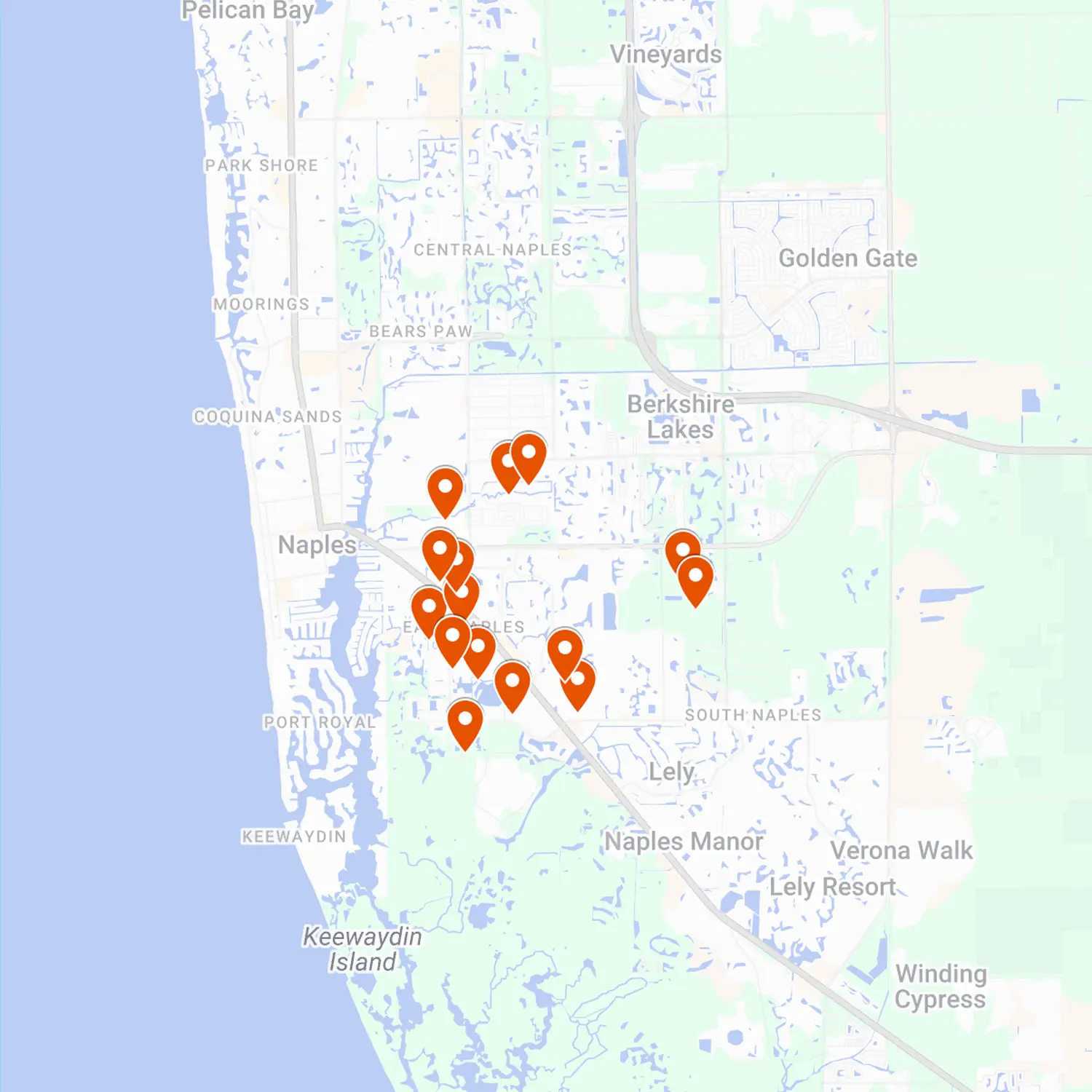

Our rental portfolio is concentrated in high-demand growth corridors across Southwest Florida, with a specific focus on Naples and Bonita Springs. These markets consistently demonstrate strong fundamentals: population growth, resilient job markets, and long term renter demand, making them ideal for stable, income generating investments.

By concentrating our efforts geographically, we are able to streamline operations, respond to market shifts faster, and deliver consistency in both tenant experience and investor performance.

Balanced Unit Mix. Reliable Returns.

The portfolio includes a diverse mix of rental units designed to cater to a broad tenant base, including studio residences, 2-bedroom/ 2-bathroom units, and 3-bedroom/ 2.5-bathroom residences. This variety allows us to serve young professionals, growing families, and long-term residents seeking stability in high-quality neighborhoods.

Each asset is managed with discipline and care, maintaining quality standards across the board, enhancing livability, and preserving property value over time. This operational consistency supports strong occupancy levels and dependable cash flow, regardless of market cycles.

Discretion, Discipline, Long-Term Focus

At TN Capital, we follow a privacy-first approach to our rental holdings. Rather than listing individual addresses, we showcase the portfolio as a whole, preserving tenant confidentiality while highlighting our broader investment strategy.

We acquire assets with intention, improve them with precision, and manage them for lasting value. This disciplined model allows us to quietly grow a portfolio that not only generates steady returns but also contributes to the long-term health of the communities we operate in.